florida estate tax exemption

If an estate exceeds that amount. You have to apply for a property tax exemption through your local tax authority the contact details for which are available from the Florida Department of Revenue.

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

This means that when someone dies and the value of their estate is calculated any.

. The first 25000 applies to all property taxes including school district taxes. Senior Citizen ExemptionsAs much as 50000 for people who are 65 years old or older and live in Florida with an income below 20000. These forms must be filed with the clerk of the court in the county where the property is located.

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The exemption will enable you to transfer up to 115 million before incurring taxes. This exemption qualifies the home for the Save Our Homes assessment limitation.

Then you have to be age 65 or older. There are some limits to this exemption though including You must live in certain areas of the sate. That amount is reduced by any taxable gifts that one makes during life.

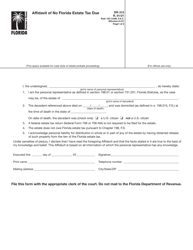

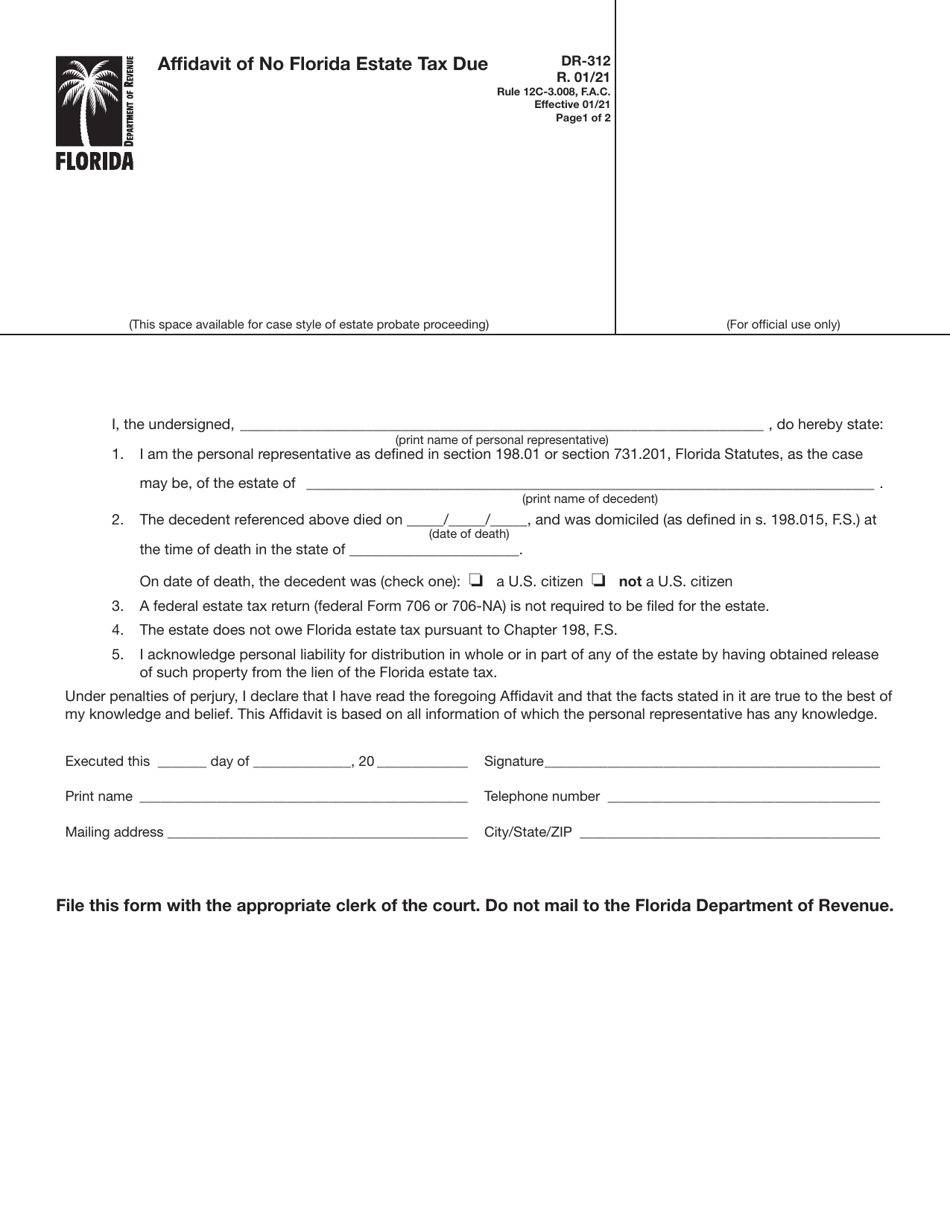

The additional 25000 exemption is available for non. Ad Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. Last year it was 15000.

You must have income that falls within certain limits. If youre 65 or older who youve lived in Florida for at least 25 years you may be eligible for up to 100 percent property tax exemptions. Applications can be made much easier by letting DoNotPay help you.

Estates of Decedents who died on or before December 31 2004. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

At the same time the Federal Gift Tax Exclusion has an annual exclusion of 16000 per donee. The filing threshold for Form 706-NA is not indexed for inflation. However the law has a sunset provision.

Certain groceries any prosthetic or orthopedic. 1 of the year you file for this exemption and had household income less than the amount set by the Florida Department of Revenue about 31100 you may be eligible for an additional exemption of up to 50000. If you are 65 years of age or older were living on your homestead property as of Jan.

Your homes value cannot exceed 250000. Florida estate tax compliance allows you to take a unified credit. The new tax law passed in 2017 doubled the lifetime unified estate tax and gift tax exemption.

The estate tax exemption is adjusted for inflation every year. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Sales Tax Exemptions in Florida.

The first 25000 in property value is exempt from all property taxes including school district taxes. Under the Florida Constitution every Florida homeowner can receive a homestead exemption up to 50000. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien.

Taxpayers Exemptions For additional Florida Real Estate information or to speak to Joe Jennings Broker at Sunny Associates about SELLING BUYING RENTING or PROPERTY MANAGEMENT please click on the link below or CALL 954-982-4842. Additionally the link will provide the necessary forms to get the tax exemption process started. Like most other states Florida does not levy a local gift tax.

An additional 25000 exemption that excludes school taxes if your assessed value. A married couple therefore has 2412 million of exemption. The federal estate tax exemption is portable for married couples.

The size of the estate tax exemption means very few fewer than 1 of estates are affected. Effective January 1 2026 the exemption will return to its 2017 levels 56 million per individual and 112 million per married couple. Homestead Exemptions Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions.

Taxable gifts are transfers exceeding the annual gift tax exclusion amount which in 2022 is 16000. In order to qualify for this additional homestead exemption you must first qualify for the first homestead exemption discussed above. The first 25000 of your homes value is not subject to property taxes.

Currently there is no estate tax in Florida. An additional 25000 applies to the amount of your homes value that is over 50000 and up to 75000. If the date of death value of the decedents US-situated assets together with the gift tax specific exemption and the amount of the adjusted taxable gifts exceeds the filing threshold of 60000 the executor must file a Form 706-NA for the decedents estate.

In Florida certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. There are two levels of the homestead exemption. The federal estate tax exemption for 2021 is 117 million.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. This page discusses various sales tax exemptions in Florida. Your spouse can also take the tax credit for generation-skipping advantages.

Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service-connected permanent and total disability is exempt from taxation of the veteran is a permanent resident of Florida and has legal title to the property on January 1 of the tax year for which. History of the Florida Estate Tax. Total and Permanent Disability ExemptionsHomeowners who are totally disabled may be exempt from all property taxes.

The current exemption doubled under the Tax Cuts and Jobs Act is set to expire in 2026. Do not send these forms to the Department. While the Florida sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

The state abolished its estate tax in 2004. The first 25000 of the exemption applies to all taxing authorities. You can find their official search function here.

Florida law provides for lower property tax assessments on homestead property. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. Estate Tax Calculator A Florida estate tax calculator will help you estimate how much you have to pay in estate taxes.

So if a married couple plans properly they can have an exemption of up to 234 million after both spouses have died. Under Article VII Section 6 of the Florida Constitution and Section 196031 Florida Statute certain property owners in Florida are eligible for exemptions that can reduce their property tax liability by decreasing the propertys taxable value by up to 50000. It means that you can gift away up to 16000-worth shares of your estate to as many people as you wish every year reducing its taxable part.

A lesser-known additional homestead exemption will allow an ADDITIONAL 2500000 - 5000000 to be deducted from the propertys assessedtaxable value. Currently everyone has an exemption of 1206 million. Florida Homestead exemption up to 50000 a.

Blind Person ExemptionsA 500 tax reduction for persons who are legally blind.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Homestead Exemption How It Works Kin Insurance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Property Tax H R Block

Florida Attorney For Federal Estate Taxes Karp Law Firm

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Florida Estate Tax Rules On Estate Inheritance Taxes

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Estate Tax Planning And Using A B Trusts For High Net Worth Estates Estate Planning Attorney Gibbs Law Fort Myers Fl

How Your Estate Is Taxed Or Not

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Inheritance Tax In Florida The Finity Law Firm

Florida Estate Planning Guide Everything You Need To Know

Florida Homestead Exemption Martindale Com

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller